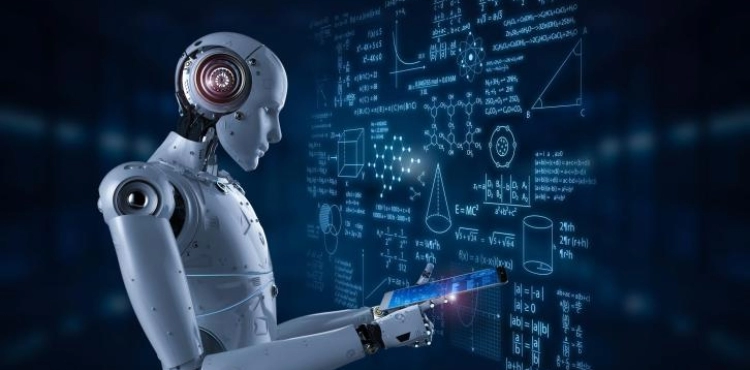

A team of researchers in the United States has created a new system of artificial intelligence that can develop and test tax systems.

The new system, developed by researchers at the American company Salesforce, a company that specializes in corporate technology, and bears the name "IL Economist", aims to help governments around the world develop fair and fair tax transaction systems.

The team of researchers stated on the company’s website that “the absence of economic justice is increasing globally and represents a growing concern because of its negative impact on economic opportunities, health and social welfare ... Taxes are an important means to reduce the lack of justice, but that a tax policy is achieved Equity with productivity is an unresolved issue. "

And the website "Tech Explorer" quoted researcher Richard Sucker, a member of the team that developed the new system, as saying that the AL Economist system relies on algorithm equations for artificial learning techniques in order to discover how new tax frameworks can help reduce the lack of justice and improve economic productivity. And ultimately make the world a better place. "

The program creates imaginary economic systems for transactions in the field of currencies, construction, etc., and then, through artificial intelligence techniques, determines the size of taxes imposed on these projects according to certain criteria with the aim of reaching the best fair formula for determining the value of the tax.

The study team confirms that their findings using the new technology are 16% more effective than the findings of traditional economists.

Researcher Alex Trott points to the problem of the impact of political considerations on tax policies, saying: "It would be nice if tax policies were less politically influenced and more dependent on available data."